What's new in eTaxBC

eTaxBC is changing on November 12, 2024 with a redesign as well as additional features for improved accessibility. Read this overview to find out about the upgrade to eTaxBC.

Note: The first time you log on to eTaxBC on or after November 12, 2024, you will be prompted to authenticate your log on by email or an authentication app.

On this page

- Highlights of changes to eTaxBC

- Preview images of the eTaxBC redesign

- How to set up your Authentication app for eTaxBC

Highlights of changes to eTaxBC

- New multi-factor authentication to improve the security of your information

- Improved design with dashboard-style screens that display visual information more effectively

- Mobile-friendly interface that displays easily on mobile devices and allows you to zoom in when viewing the page

- New layout and table structure to improve accessibility when viewing with assistive technologies

- Improved keyboard interaction with tab controls

- New application feature that allows screens to describe changes for those who use assistive technology

- Improved dialog and interactive tooltip keyboard handling along with descriptive text

Preview images of the eTaxBC redesign

The following screen images are examples of some of the pages you'll see in the new eTaxBC redesign. You can view all of the new pages and functions when the eTaxBC upgrade goes live on November 12, 2024.

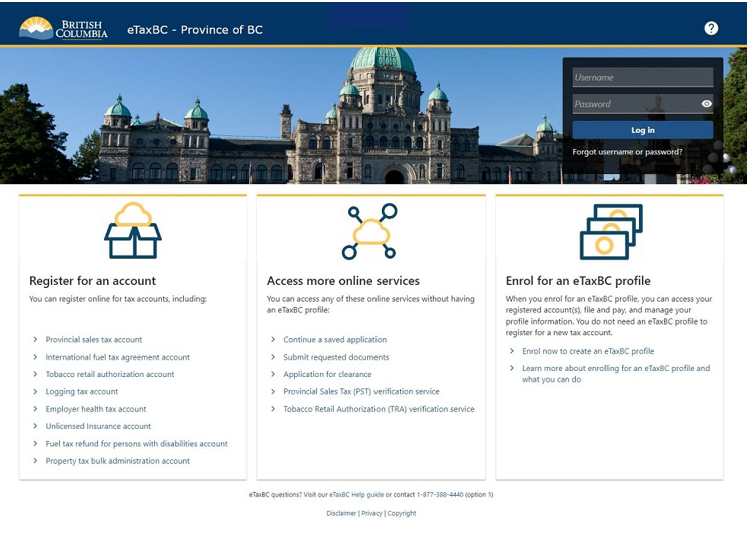

eTaxBC homepage

The new eTaxBC homepage includes options to register for various tax accounts, access more online services, and enrol to create an eTaxBC profile.

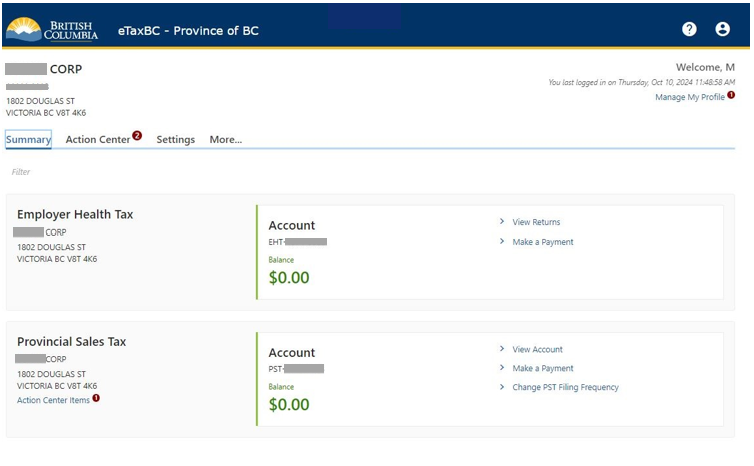

Summary tab

On the main summary tab, you can view your accounts, such as employer health tax and provincial sales tax. You can also view a return, make a payment, and change your filing frequency.

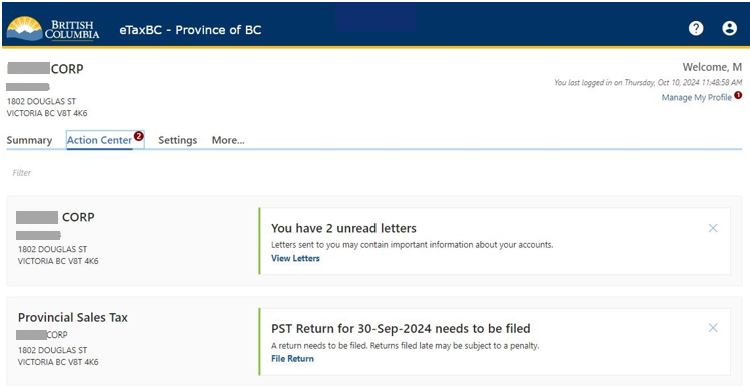

Action Centre tab

The main Action Centre tab lets you view your accounts as well as view related letters. You can also file a return.

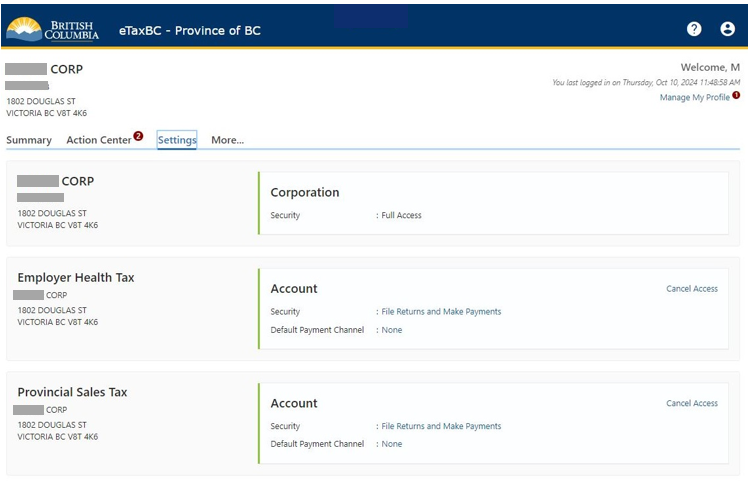

Settings tab

The Settings tab is where you can have full access to the settings related to your business profile. You can also view your accounts, file returns and make payments.

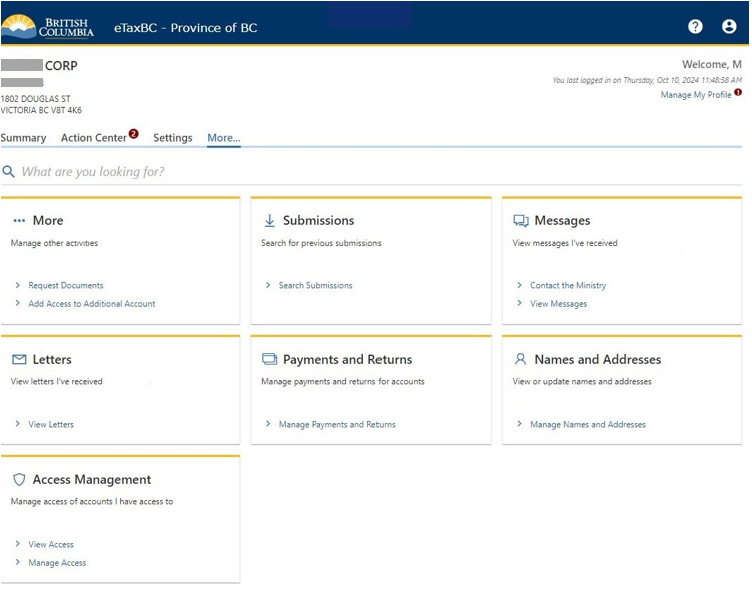

More tab

Functions that were previously found under the "I want to..." prompt in eTaxBC will be found under the More tab. There are many functions you can access, including:

- Request documents and add access to an additional account

- Search for previous submissions

- View messages you've received

- View letters you've received

- Manage payments and returns for your accounts

- View and update names and addresses for your accounts

- View your accounts and manage access to them

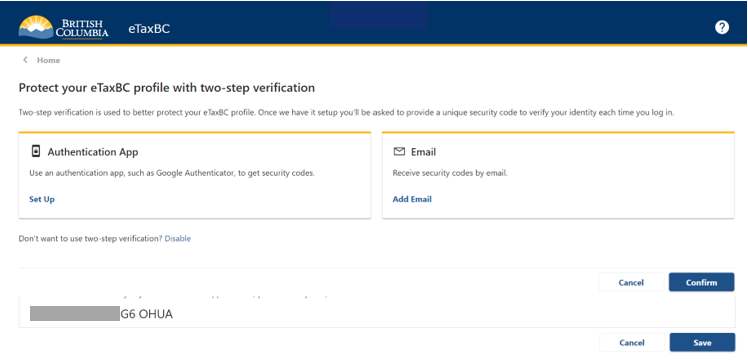

How to set up an authentication app for eTaxBC

On November 12, 2024, eTaxBC will offer two authentication options:

- Authenticate by email

- Authenticate by using a third-party app on your phone (such as Google Authenticator).

Note: The Ministry of Finance does not provide support for third party authentication apps as they are external to eTaxBC.

Here's how to authenticate using an app:

Step 1

Select Authentication App and then select the Set Up link.

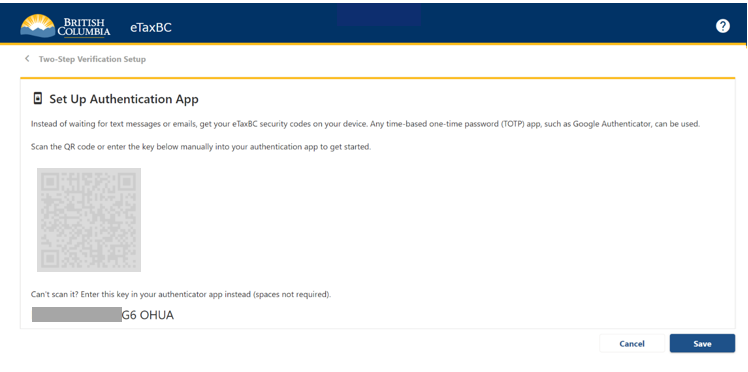

Step 2

Scan the QR code or manually enter the 16-character key below the code into your Authenticator app and then press the Save button on this screen.

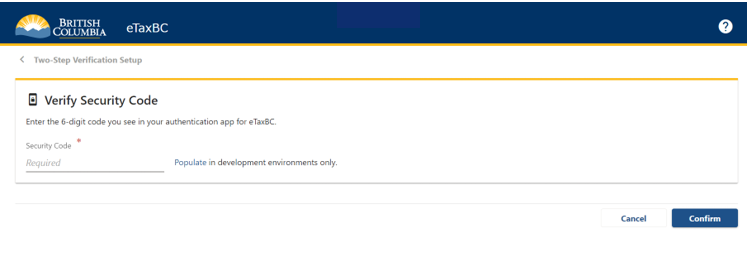

Step 3

In the next screen, eTaxBC will ask you to enter the code that your Authentication app provides to you. Once this has been entered correctly, press Confirm button on this screen and you will be able to access your eTaxBC profile.

Contact information

Our eTaxBC help desk is available on weekdays from 8:30 am - 4:20 pm Pacific Standard Time.

1-877-388-4440