2. Indirect Control through two or more intermediate entities or persons

Many private B.C. companies have straightforward legal structures. It is expected that most cases of indirect control will only have one intermediate entity or person between the private company and the significant individual.

Sometimes, however, there is more than one intermediate entity or person between the private company and the significant individual. In this case, you must continually look through this chain of intermediaries until you find the natural person at the top of the chain (significant individual), or conclude there are no significant individuals with indirect control.

Under the Business Corporations Regulation a chain of intermediaries exists when there are two or more intermediate entities or persons between the private company and the significant individual. An intermediate entity or person can be a:

Indirect control may be difficult to identify within a chain of intermediaries. If there is any uncertainty with this issue, you should seek advice from a legal professional.

If the intermediate entity or person is not a natural person, you must keep going until you identify a natural person – that is, a human being. If you identify a natural person but the natural person is controlled by another entity or person, your work is not done: a significant individual must not be controlled by anyone else.

Note: Always remember that only a natural person at the top of the chain of intermediaries, who is not controlled by another, can be listed as a significant individual in your company’s register.

a. What do I do when the company holding the votes or shares of my company is owned by another company or corporation?

If the shares of your company are held through a chain of companies or corporations, you have to get information on every intermediate company or corporation in the chain until you identify the natural person at the top of the chain.

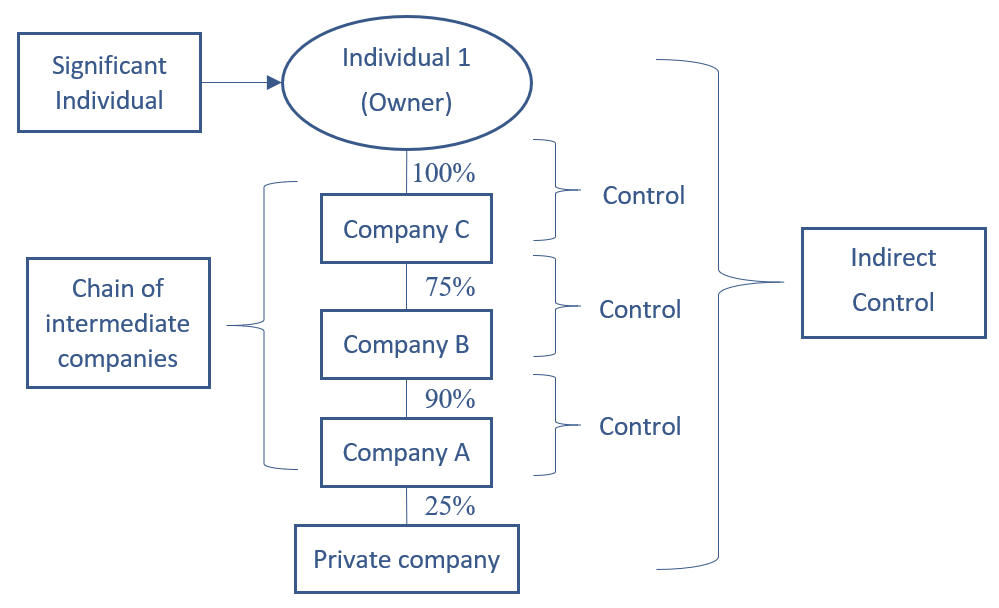

Control of a chain of intermediate companies

The test for control of a company or corporation is the ability to elect or appoint a majority of the directors of the company or corporation. This ability can come through holding enough shares with votes (more than 50%) or through being given the right to appoint directors (separate from shares) in the articles or other shareholders’ agreements.

Example 1 - Control of a chain of intermediate companies

In the diagram above, there is an unbroken line of control from Individual 1 to Company A. As a result, Individual 1 has indirect control of 25% of the shares or votes of the private company and must be listed as a significant individual in the private company’s register.

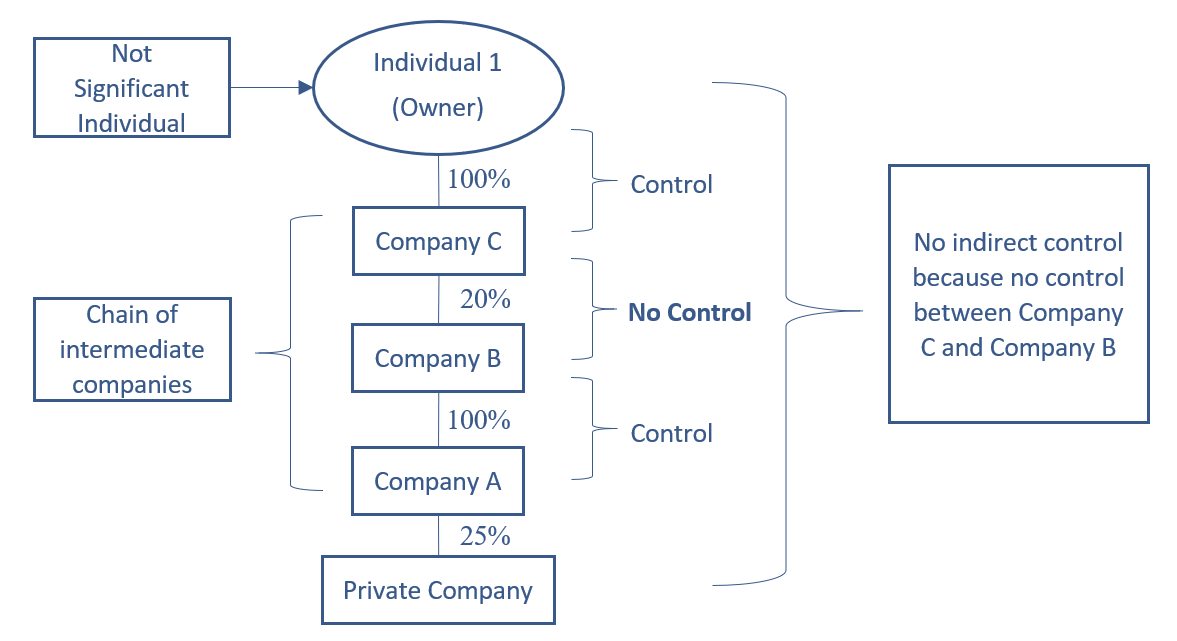

Note: If there is no control at every link in the chain, then there is no indirect control as defined in the legislation.

Example 2 - No control of a chain of intermediate companies

In the diagram above, Individual 1 does not have indirect control of 25% of the shares of the private company because of the break in the line of control.

b. What do I do when an intermediate entity or person in the chain of intermediaries is a partnership, an agent, a trustee of a trust, or a personal or legal representative?

It is possible for a partnership, an agent, a trustee of a trust or a personal or legal representative to be an intermediate entity or person in a chain of intermediaries. These instances are not as straightforward as the scenarios discussed above.

Each of these types of intermediary has its own test of control set out in the amendments to the Business Corporations Regulation. The following examples are only given to show what control looks like within a chain of intermediaries. The regulation is the true source of defining indirect control.

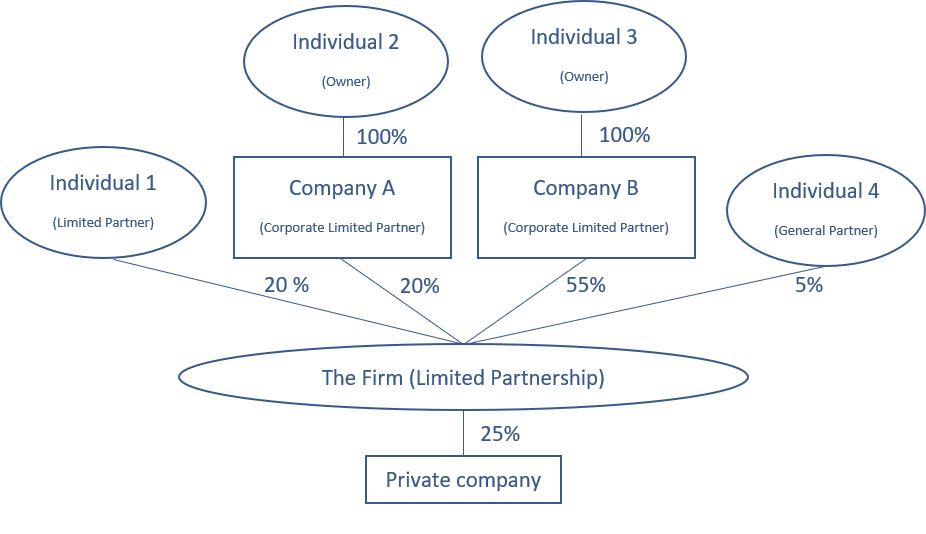

Control of intermediate partnership

The shares of a private company can be held by a partnership. Every general partner and non-limited partners in the partnership is considered to control the partnership.

Limited partners are considered to control the partnership if they meet one of the following criteria:

- entitled to at least 25% of the profits of the partnership

- entitled to at least 25% of the assets of the partnership on windup

- has at least 25% of the votes in partnership management

- has the right to appoint or remove the majority of the partnership's management

The partnership agreement should be consulted in order to determine who, if any anyone, meets the above criteria.

If the partner controls the partnership and is a company or corporation then you will need to apply the test for control of a company or corporation described above to determine who, if anyone, controls the corporate partner.

Example - Control of intermediate partnership

In the diagram above, Individual 1 does not control the partnership because Individual 1 is a limited partner entitled to less than 25% of the profits of the partnership. Individual 4 controls the partnership because Individual 4 is a general partner.

Company A does not control the partnership since Company A is a limited partner entitled to less than 25% of the profits of the partnership. As a result, the chain of control does not continue from the partnership through to Individual 2 and Individual 2 is not a significant individual.

Company B does control the partnership since Company B is a limited partner entitled to at least 25% of the profits of the partnership. Since Individual 3 controls Company B, Individual 3 controls the partnership as well and has indirect control of the shares of the private company.

Overall, Individual 4 and Individual 3 are both significant individuals of the private company by having indirect control of at least 25% of the shares of the Private Company.

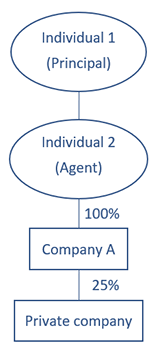

Control of intermediate agent

An agent is controlled by their principal through the operation of the law. If the principal is a natural person and not controlled by another entity or person, that principal is a significant individual with indirect control of the shares of the private company and must be listed in the company’s register.

Example - Control of intermediate agent

In the diagram above, Individual 2, the agent, holds 100% of Company A’s shares on behalf of Individual 1, the principal. This means that Individual 1 can direct how Individual 2 exercises the rights attached to Company A’s shares, including the rights attached to the private company’s shares. As a result, Individual 1 has indirect control of 25% of the shares or votes of the private company and must be listed as a significant individual in the private company’s register. (In this example, the agent is not listed as a registered owner of the private company’s register. The agent is the registered owner of Company A, not a registered owner of the private company.)

Control of intermediate trustee of a trust

A trustee is the legal owner of trust property that is held “in trust” for others (the beneficiaries). As a result, the trustee controls the trust property. Trustees of a trust will hold the control of the voting rights, shares or right or ability to elect, appoint or remove directors of a private company. If the trustee is a natural person and not controlled by another entity or person (see note below), the trustee must be listed as a significant individual in the private company’s register.

If the trustee is a company or corporation then you will need to determine if anyone controls the corporate trustee.

- If a person controls the corporate trustee as described above (control test for trusts), you follow that chain of control and ignore the shareholders of the corporate trustee;

- If no person controls the corporate trustee as described above (control test for trusts), you need to look into the shareholders of the corporate trustee to determine if any person controls the trustee according to corporate control test.

Note: It is also possible that the instrument creating the trust may provide this control to another individual or group of individuals, such as the settlor or beneficiaries. For example, the terms of the trust may specify an individual with the power to direct how the trustee is to exercise:

- any of the rights of the property

- any right to elect directors, or

- control over an intermediary

If any of the above is true, then that individual is also considered to control the trustee. That individual should also be listed as a significant individual in the private company’s register, along with the individual trustee.

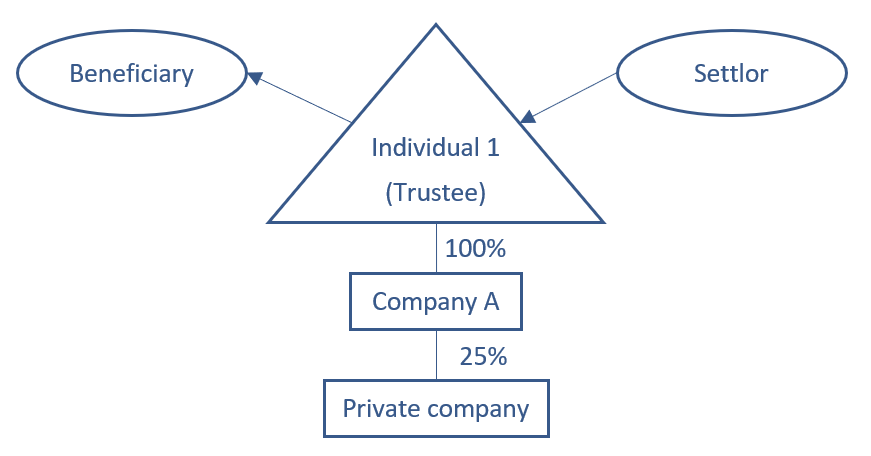

Example - Control of intermediate trustee of a trust

In the diagram above, Individual 1, the trustee, controls Company A. Company A holds 25% of the shares of the private company. As a result, Individual 1 has indirect control of 25% of the shares or votes of the private company and must be listed in the private company’s register. (In this example, the trustee is listed as a significant individual with indirect control, but not as a registered owner. The trustee is the registered owner of Company A, not a registered owner of the private company.)

The beneficiary and the settlor are not considered to control Individual 1, unless there is evidence in the instrument creating the trust that they can direct how Individual 1 is to exercise control over Company A. The beneficiaries do not need to be listed as significant individuals in the private company’s register. (In this example, the beneficiary is not listed as a beneficial owner in the private company’s register either. The beneficiary is a beneficial owner of Company A, not a beneficial owner of the private company.)

Control of intermediate personal or legal representative

A person can appoint a personal or other legal representative, such as an attorney under a power of attorney, to represent or act for them with respect to their property. The represented person retains legal ownership but delegates control of the property to another. For instance, an individual can appoint their spouse as their representative to exercise their voting rights in the family business in case they are unable to do so themselves, or otherwise become incapacitated. The incapacitated individual legally retains ownership, but the individual's spouse now exercises the voting rights in the business.

Just like the trustee of a trust, the personal or legal representative is considered to control the property they hold on behalf of another person, including the rights attached to the shares of a private company. Therefore, the personal or legal representative must be listed as a significant individual in the private company’s register. However, unlike the trustee of a trust, the personal or legal representative is not typically the owner of the property.

Note: It is generally the case that the representation agreement will not provide the personal or legal representative with full control of the rights attached to the shares of the company with no direction from the represented person. In such a case, both the represented person and the personal or legal representative must be listed in the transparency register. In the rare circumstances where full control is in the hands of the personal or legal representative (e.g., due to incapacity), then only the personal or legal representative needs to be listed.