Filing instructions for charitable or non-profit employers for the employer health tax

This guide explains how to complete the employer health tax return for charitable or non-profit employers.

- Due date

- Before you file

- Step 1: Declarations

- Step 2: BC Remuneration

- Step 3: Tax Payable

- Step 4: Payments

- Step 5: Summary and Certification

- Confirmation

Due date

Your annual employer health tax return is due on March 31 of the following calendar year.

If this is your final taxation year for the employer health tax, your return is due either:

- 90 days after the date you cease your permanent establishment in B.C.

- 90 days after the date you become bankrupt

Before you file

Before you file your return, ensure you have the following:

- Your username and password for your employer health tax account in eTaxBC

If you don’t have an eTaxBC logon set up for your employer health tax account, you'll need to:- Enrol for access to eTaxBC

- Log on and add access to your employer health tax account

-

T4 Summary or Summaries from all payroll accounts under the same business number, which is the first nine digits of the Canada Revenue Agency (CRA) payroll account number

-

The total Non-BC Remuneration from all payroll accounts that were included on Line 14 of the T4 Summary or Summaries

-

If applicable, your T4 Slips from all payroll accounts

-

If applicable, your T4A Slips from all payroll accounts

-

Qualifying Location information with valid address(es) (includes city and postal code) if you have more than one qualifying location and haven’t registered them with the ministry yet

Once you have all the above, you can begin filing your employer health tax return:

- Log on to your eTaxBC account

- Select Employer Health Tax under Accounts

- Select File Return for the period you wish to file

Step 1: Declarations

Follow the instructions below for the Declarations step.

-

Period Covered

Defaults to the taxation year you’re filing for -

Date Due

Defaults to the due date of the return -

Have you registered, or will you be registering, any qualifying locations?

-

Select Yes if you’re reporting more than one qualifying location

Ensure all locations have valid addresses and meet all three criteria to be a qualifying location. -

Otherwise, select No

-

-

Did you amalgamate within the calendar year?

-

Select Yes if an amalgamation happened during the taxation year. Then:

-

Indicate if you’re filing the return as the predecessor or successor

-

Enter the effective date of the amalgamation

If you’re filing as the successor corporation, you’re deemed to be a new employer starting on the effective date of the amalgamation. The exemption and notch rate amounts will be prorated accordingly.

If you’re filing as the predecessor and you’re not reporting more than one qualifying location, go to Step 2: BC Remuneration in the filing instructions for employers.

-

-

Otherwise, select No

-

-

Is this the final taxation year for this employer?

-

Select No if you’ll be subject to the employer health tax after this filing

-

Otherwise, select Yes and select the reason for the account closure

-

-

Did you have at least one Permanent Establishment in BC on December 31st?

-

Select Yes if you had at least one permanent establishment in B.C. on December 31st of the taxation year

-

Otherwise, select No and enter the date when you cease to have a permanent establishment in B.C.

-

Step 2: BC Remuneration

For the BC Remuneration Step:

-

If you’re reporting more than one qualifying location, see Step 2A: Qualifying Locations Reported

-

If you’re not reporting more than one qualifying location, see Step 2B: No Qualifying Locations Reported

Step 2A: Qualifying Locations Reported

If you’re reporting more than one qualifying location, the following fields are automatically calculated based on what you’ll enter in the Qualifying Location Summary at the bottom half of the screen:

-

BC remuneration

Defaults to the total Taxable B.C. Remuneration calculated from the Qualifying Location Summary -

Tax payable

Defaults to the total Tax Payable calculated from the Qualifying Location Summary -

Exemption threshold per location: (number of days in the taxation year / number of days in year) x $4,500,000.00

The calculation of the exemption threshold based on the number of days that each qualifying location that had a permanent establishment in B.C. in a calendar year

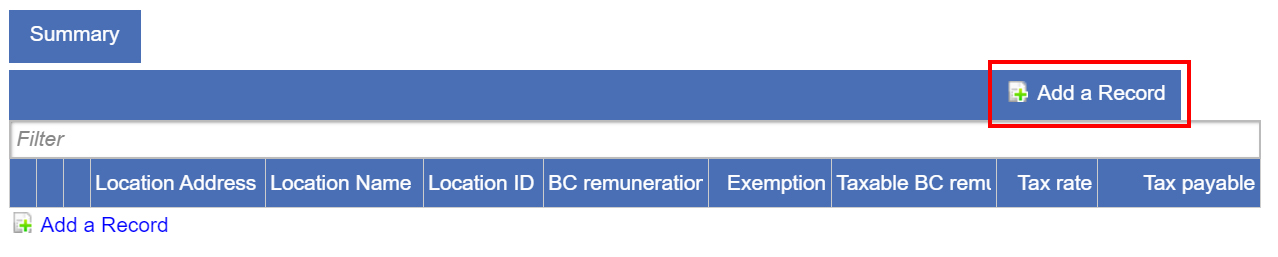

Qualifying Location Summary

The Qualifying Location Summary allows you to add and provide details of your qualifying locations.

If you’ve already registered your qualifying locations, they’ll be listed as a separate tab for each qualifying location.

If you haven’t registered your qualifying location(s) yet or if you missed one, add them in this section.

To add a qualifying location, select Add a Record.

Whether the location is already listed, or you’re adding it for the first time, you must fill out all the required fields for each location:

-

Location Address

If you haven’t pre-registered the qualifying location, enter the location’s address with city and postal code -

Location Name

If you haven’t pre-registered the qualifying location, enter the location’s name -

Location ID

The Location ID is shown if the qualifying location has been pre-registered. Otherwise, it’s left blank. -

Line 100 - Total Remuneration for this location included in line 14 of the T4 summary

Enter the total remuneration reported on Line 14 of your CRA T4 Summary for the calendar year for this location

If you have multiple CRA payroll accounts (e.g. to track employment income from different provinces, employment types, payment types):-

Add the amounts reported on Line 14 of all T4 Summaries from all CRA payroll account(s) of the same business number

-

Allocate the total B.C. remuneration to each qualifying location

-

Enter the amount for this location

Note: B.C. remuneration from non-qualifying locations should be added to a qualifying location’s B.C. remuneration.

-

-

Line 110 – Remuneration paid to employees outside BC

Enter the amount of remuneration paid to employees who report for work at the employer’s permanent establishment outside B.C. for this location for all or substantially all of the calendar year -

Line 120 – Subtotal

Shows the difference between lines 100 and 110 -

Line 130 – BC remuneration not declared on T4 Summary

Enter the amount that was not included in line 100 but is part of B.C. remuneration (e.g. taxable remuneration reported on T4A or other slips) for this location -

Line 190 – BC remuneration

Shows your B.C. remuneration for this location, the sum of lines 120 and 130 -

Line 310 – Applicable exemption

Shows the exemption amount available for this location -

Line 320 – Taxable BC Remuneration

Shows the difference between lines 190 and 310 -

Line 700 – Tax Rate

Shows the tax rate for this location -

Line 770 – Tax payable

Shows the employer health tax payable for the taxation year for this location, which is line 320 multiplied by line 700

When you’ve added all your qualifying locations and completed all applicable fields, go to Step 3: Tax Payable.

Step 2B: No Qualifying Locations Reported

If you’re not reporting more than one qualifying location, follow the instructions below:

-

Line 100 – Total Remuneration

Enter the total remuneration reported on Line 14 of your CRA T4 Summary for the calendar year

If you have multiple CRA payroll accounts (e.g. to track employment income from different provinces, employment types, payment types), add the amounts reported on Line 14 of all T4 Summaries from all CRA payroll account(s) of the same business number and enter that amount. -

Line 110 – Remuneration paid to employees outside BC

From the amount entered in line 100, enter the amount of remuneration paid to employees who report for work at the employer’s permanent establishment outside B.C. for all or substantially all of the calendar year -

Line 120 – Subtotal

Shows the difference between lines 100 and 110 -

Line 130 – BC Remuneration not declared on T4 Summary

Enter the amount that was not included in line 100 but is part of B.C. remuneration (e.g. taxable remuneration reported on T4A or other slips) -

Line 190 – BC Remuneration

Shows your B.C. remuneration, the sum of lines 120 and 130

Step 3: Tax Payable

The Tax Payable step shows the following automatically calculated fields:

-

Line 300 – BC Remuneration

The B.C. remuneration from ‘BC remuneration’ in Step 2A or line 190 in Step 2B -

Line 310 – Exemption applied

The total exemption amount applied from all qualifying locations -

Line 320 – Taxable BC remuneration

The total Taxable B.C. remuneration from either:-

The ‘Summary’ in Step 2A

-

The difference between lines 300 and 310 in Step 2B

-

-

Line 700 – Tax rate

The tax rate from either:-

The ‘Summary’ in Step 2A if all qualifying locations are using the same tax rate

-

‘Multiple Rates Found’ if multiple tax rates are found in the ‘Summary’ in Step 2A

-

The tax rate in Step 2B

-

-

Line 770 – Tax payable

The employer health tax payable for the taxation year from either:-

‘Tax payable’ in Step 2A

-

Line 320 multiplied by line 700 in Step 2B

-

Step 4: Payments

The Payments step shows the following fields. These fields are automatically calculated except for the last bullet:

-

Line 840 – Instalment payments received

The total of all instalment payments paid to date -

Line 842 – Prior year’s overpayment applied

Any credit balance carried over from the previous year -

Line 844 – Subtotal

The total of lines 840 and 842 -

Line 846 – Tax due (or overpaid)

Your account balance, which is the difference between line 770 in Step 4 and line 844. This is your amount payable or overpayment. -

If applicable, overpayment to be:

Select one of the following, regardless of whether you’ll have an amount payable or an overpayment:

-

Applied to subsequent year if you want to carry forward your overpayment to the subsequent year

-

Refunded if you want your overpayment amount to be refunded

Step 5: Summary and Certification

The Summary and Certification step allows you to review and make changes to your tax return before submitting it. If you need to make changes in the Multiple Locations Declaration table, go back to Step 2.

To submit your tax return, you must certify it by:

- Entering your first name

- Entering your last name

- Entering your position title

- Reading and checking the box beside the certification statement

- Selecting Submit

Confirmation

Once the return is submitted, a confirmation number will be issued as proof of your submission. It’s recommended that you print or take a screen shot of the confirmation page for your records.

If your tax return has a balance due, see payment options.

Enrol for access to eTaxBC to manage your account, file returns or make payments online.

Already have an account? Log on to eTaxBC

For help, visit the eTaxBC help guide.

You can pay your employer health tax balance:

Filing instructions are also available for:

Contact information

1-877-387-3332

250-387-3332