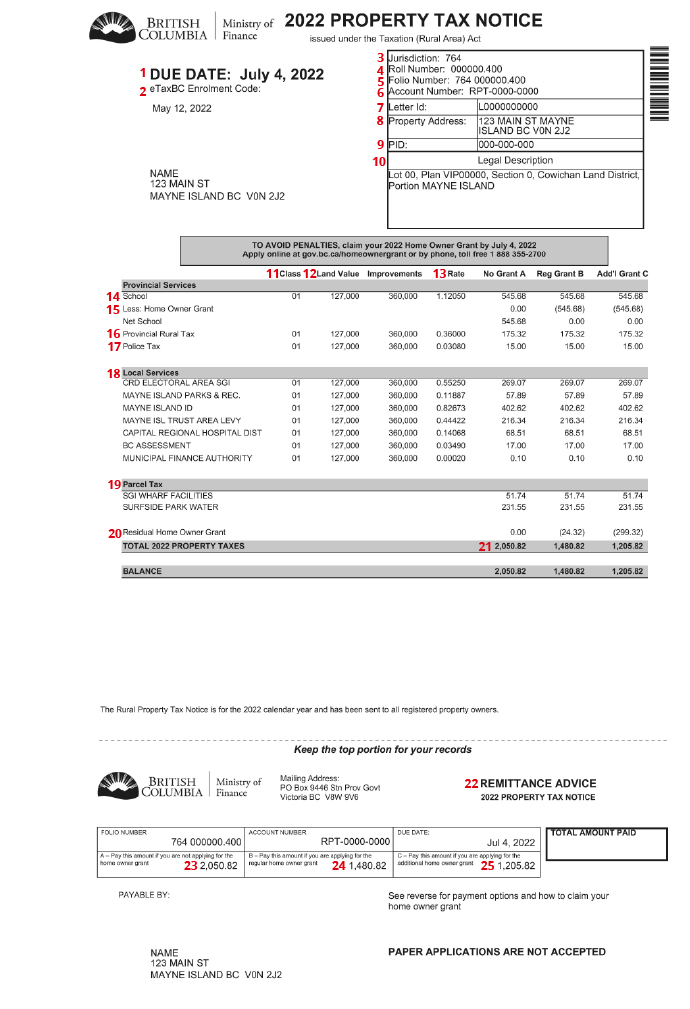

Sample rural property tax notice

The following in an example of a tax notice for a property located in a rural area:

-

Due date

The date your taxes are due. If you do not pay your taxes on or before this date, you will be charged late payment penalties. -

Enrolment code

The code that you will use when you enrol for access to eTaxBC to pay your property taxes, claim your home owner grant, view or print your tax notice and manage your account. -

Jurisdiction

The first 3-digits of the folio number is the assessment jurisdiction. -

Roll number

A number assigned to the property for assessment administrative purposes. -

Account number

The code that identifies you as a property taxpayer. -

Parcel identifier (PID)

The number assigned by the Land Title and Survey Authority that identifies your piece of land. -

Legal description

The physical description of the property as it is registered with the Land Title and Survey Authority. -

Class

The type or use of your property determined by BC Assessment. There are nine different classes that your property can be categorized into. Each property class has its own tax rate. -

Land value and improvements

The assessed value, determined by BC Assessment, of your land and any improvements (such as buildings) on the land that are taxable. -

Rate

The tax rate that is being applied to the land value, improvement value or both. -

School tax

Property owners share the cost of providing education in British Columbia even if they do not use the services. You are required to pay school taxes on each property you own, unless the property qualifies for:

- Agricultural Land Reserve (ALR) Exemption

- Alternative Energy Power Projects Exemption

- Provincial Industrial Property Tax Credit

- Provincial Farm Land Tax Credit

If the residential portion if your property is assessed over $3 million, you may also see an amount for the additional school tax.

-

Less: home owner grant

The eligible home owner grant amount that reduces school tax. Any eligible remaining home owner grant will be applied to other taxes. -

Provincial rural tax

The provincial rural tax helps fund provincial services in rural areas including maintenance and snow removal for public secondary roads (does not include highways or private roads). -

Police tax

All property owners in a rural area pay police tax. The tax rate for police tax is the same within each regional district electoral area. -

Local services

Specific local services are listed on your property tax notice. You are required to pay for local services when your property is within a local service area's boundaries. All property owners within a local service area share the cost of local services even if they do not use them.

The province bills and collects taxes on behalf of a variety of provincial and local government taxing jurisdictions to fund local services, including:Local services are often identified with the name of your community. To check the local services that apply to your property, call your regional district finance or planning office.

- Regional Districts

- Improvement Districts

- Regional Hospital Districts

- BC Assessment Authority

- Municipal Finance Authority

- Islands Trust

- British Columbia Transit Authority

- TransLink

- University Endowment Lands

-

Parcel tax

A tax amount that spreads the cost of a service equally between taxpayers in a service area regardless of assessed value. -

Residual home owner grant

The remaining home owner grant amount available to be applied to other taxes after it has been applied to the school tax. -

Total 2021 property taxes

The total net tax payable for the current year. -

Remittance Advice

When you pay by mail or at a government office, submit the remittance advice with your payment. You can also pay your property taxes online through eTaxBC or through a bank or financial institution. You do not need to submit the remittance advice if you pay online.

Note: This is not your Home Owner Grant application. Learn how to apply for the home owner grant. -

A

The amount of property tax you owe if you or the property don't qualify for the home owner grant. -

B

The amount of property tax you owe if you qualify and apply for the regular home owner grant. If the property does not qualify for the grant, the full tax total will be displayed. -

C

The amount of property tax you owe if you qualify and apply for the additional home owner grant. If the property does not qualify for the grant, the full tax total will be displayed.

If you have any questions about your rural property tax notice please refer to the contact information on the back of your property tax notice.