Gambling revenue distribution

Money generated by gambling in B.C. is used to provide key services, including health care and education, to people and supports economic development in local communities throughout B.C.

On this page

- Overview

- Revenue from commercial gambling in B.C.

- Revenue to community organizations

- Revenue to host local governments

- Revenue to support horse racing

Overview

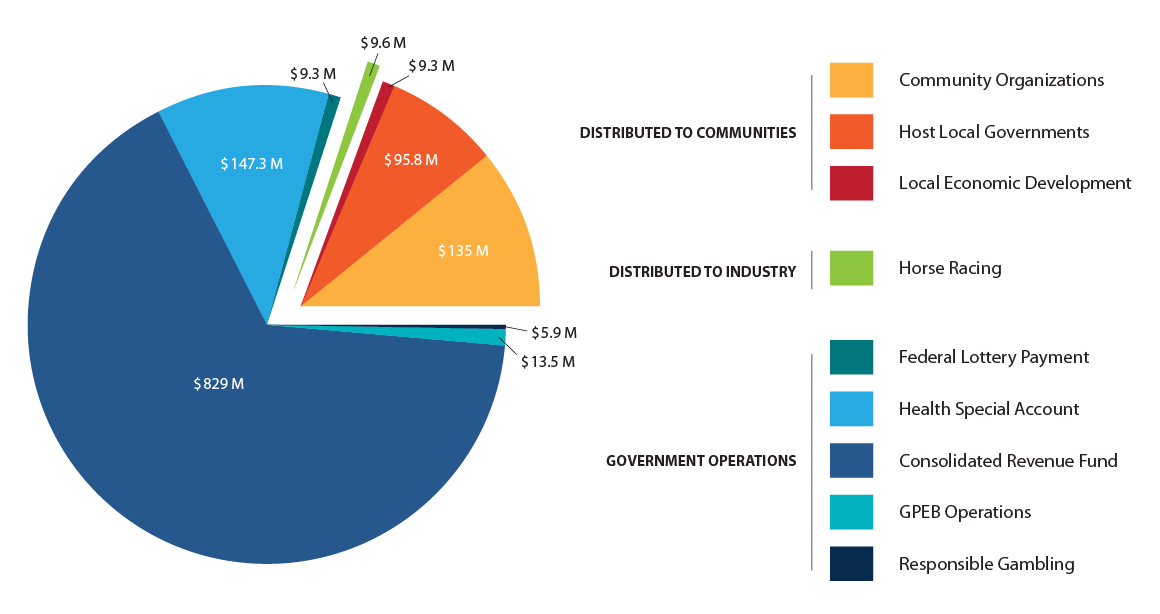

This overview shows the distribution of revenues from commercial gambling in British Columbia. Figures are for 2014/15 unless otherwise noted.

Gambling revenue

Total revenues from commercial gambling in B.C. were $2.9 billion in 2014/15, excluding horse racing. After expenses, including prize payouts, total government revenues from gambling were about $1.25 billion. This revenue benefits the people and communities across B.C.

Distribution of gambling revenue for fiscal year 2014/15

| Gambling Revenue Distributed in Fiscal Year 2014/15 to | Category | Amount |

|---|---|---|

| Non-profit community organizations | B.C. communities | $134.8 million |

| Local governments that host casinos and community gambling centres | B.C. communities | $95.8 million |

| Local economic development projects | B.C. communities | $9.3 million |

| Horse racing | B.C. industry | $9.6 million |

| Gaming Policy and Enforcement Branch (GPEB) core operations, including salaries and business expenses | B.C. government | $13.5 million |

| Responsible gambling education and problem gambling services | B.C. government | $5.9 million |

| Health Special Account, to support health care services and research | B.C. government | $147.3 million |

| Consolidated revenue fund, to support other government programs, primarily health care and education | B.C. government | $829.0 million |

| Subtotal (the Province's share) | $1,245.2 million | |

| Government of Canada transfer under a federal/provincial lottery agreement | Government of Canada | $9.3 million |

| Total | $1,254.5 million |

Revenue from commercial gambling in B.C.

In 2014/15, more than $1 billion of gambling revenue helped fund health care, education and community programs across B.C.

Revenue to community organizations

The Community Gaming Grants program distributes $140 million annually from commercial gambling revenues, to not-for-profit organizations. Grants support the delivery of ongoing programs and the completion of capital projects that directly benefit communities throughout B.C. Explore the Community Gaming Grants webpage to learn more about the available grants and how revenue is distributed.

Revenue to host local governments

The Province shares gambling revenue with local governments that host casinos and community gambling centres in B.C.

Host local governments receive ten per cent of the net casino gambling revenue from community casinos and community gambling centres in their jurisdiction.

In 2016/17 the Province distributed $96.8 million to host local governments.

Host local governments may use this revenue for any purpose within their legal authority, but must submit annual reports to the Gaming Policy and Enforcement Branch using the Host Local Government Revenue and Expenditure Report Form (PDF). The reports are due on March 15.

For reports on casino gambling revenues and community gambling centre revenues shared with local governments, see Reports, publications and statistics.

Revenue to support horse racing

Supporting the revitalization of B.C.’s horse racing industry is important to government. In response to declining revenues within the horse racing industry over the past decade, industry organizations requested the intervention of the provincial government in 2009 to stabilize and revitalize racing in B.C. The B.C. Horse Racing Industry Management Committee (HRIMC) was formed with the full authority to provide strategic direction, decision-making, and business leadership to the horse racing industry with the aim of revitalizing the industry.

As part of its commitment to the horse racing industry in B.C., the Province has allocated 25 per cent of net revenues from slot machine profits at casinos that are located at Hastings and Fraser Downs race tracks to support industry. In 2014/15, these revenues totaled $9.6 million.

Contact information

Contact the Gaming Policy and Enforcement Branch if you have questions about gambling in B.C.