Solve technical problems in eTaxBC

Note: The first time you log on to eTaxBC on or after November 12, 2024, you will be prompted to authenticate your log on by email or an authentication app.

eTaxBC has some technical features to ensure your account is secure.

Find out:

- Why you may need an access code when you log on

- How to set up your authentication app in eTaxBC

- How to recover your username or password

- Why your session may have ceased

- Why your log on credentials don’t work

Access code for eTaxBC accounts

For security reasons, if you have an eTaxBC account, you will be asked to provide an access code if:

- You are logging in to eTaxBC for the first time on or after the upgrade on November 12, 2024

- It’s your first time logging on to eTaxBC since the two-step authentication was implemented in December 2015

- You’re using a different computer from the one you used the last time you logged on to your account

- You’ve switched internet browsers or deleted your browser cookies since the last time you've logged on

The access code sent to your email will be different every time you are required to enter one.

If you don’t receive an access code, call us toll free at 1-877-388-4440 (option 1). You must be an authorized contact on the account before we can provide you with the access code. The access code should be received within 1 to 2 minutes. However, depending on your server, it could take up to 30 minutes for you to receive your code.

Set up your Authentication app for eTaxBC

On November 12, 2024, eTaxBC will offer two authentication options:

- Authenticate by email

- Authenticate by using a third-party app on your phone (such as Google Authenticator).

Note: The Ministry of Finance does not provide support for third party authentication apps as they are external to eTaxBC.

Here's how to authenticate using an app::

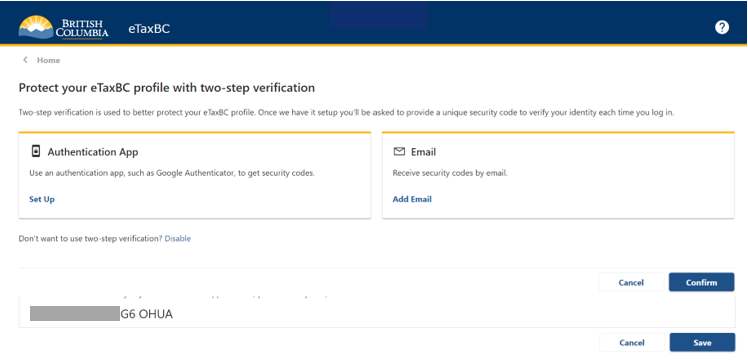

Step 1

Select Authentication App and then select the Set Up link.

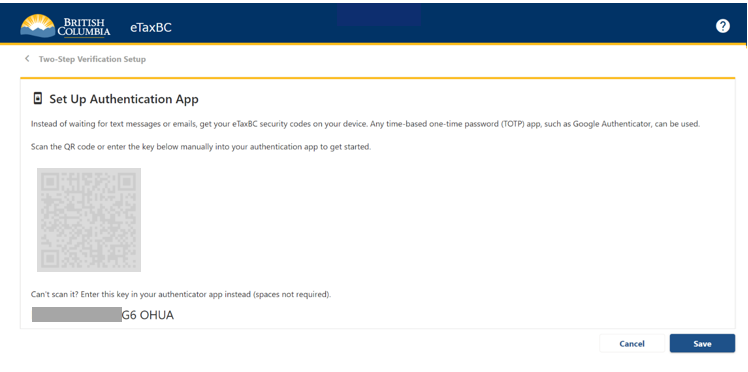

Step 2

Scan the QR code or manually enter the 16-character key below the code into your authenticator app and then press the Save button on this screen.

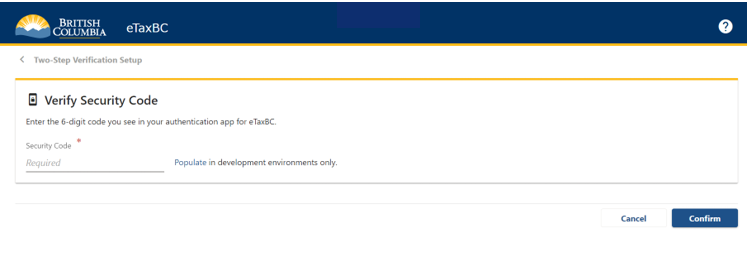

Step 3

In the next screen, eTaxBC will ask you to enter the code that your Authentication app provides to you. Once this has been entered correctly, press Confirm button on this screen and you will be able to access your eTaxBC profile.

Recover your username or password

If you forgot your username or password, you can retrieve them online using eTaxBC.

If you forgot your password, select Forgot Password? You’ll need your username and answer to the secret question that you chose for your eTaxBC account.

If you forgot your username, select Forgot Username?. You’ll need the email address that is associated with your eTaxBC account.

If you are unable to retrieve your information by following the steps above, you can call 1-877-388-4440 (option 1) between 8:15 am to 4:25 pm Pacific Standard Time, Monday to Friday. You will need your legal name, business number and account number when you call. You must be an authorized contact on the account. To add new authorized contacts to an account, please submit a completed Authorization form (FIN 146) (PDF, 260MB). Note: we are unable to give you your current password.

Session ceased

Your session will cease and you will receive an error message if your IP address changes while using eTaxBC. Your IP address may change if you are switching between networks or accessing the internet through a public wireless network. A consistent IP address is required each time you log on. You must use a secure site with a stable, static network connection when you log on to eTaxBC to prevent unauthorized access to your personal information.

Logon failure

You may have trouble logging on if:

-

You’re using an old link to eTaxBC. Make sure you’re using the correct link to eTaxBC

-

You’re using an incorrect username or password. Note: Your password must contain a minimum of 8 characters, which includes both numbers and letters (letters must be both uppercase and lowercase)

Find out how to log on if you forgot your username or password.

Manage your account, file returns or make payments online using eTaxBC.

Don't have an eTaxBC account? Enrol now.

eTaxBC is a convenient online service that allows you to manage your account, file returns, make payments and communicate with ministry staff.

Find out more about eTaxBC and what types of accounts are available.

Contact information

Our eTaxBC help desk is available on weekdays from 8:30 am - 4:20 pm Pacific Standard Time.

1-877-388-4440